What is the Dividend Discount Model?

The Dividend Discount Model (DDM) is a quantitative method of valuing a company’s stock price based on the assumption that the current fair price of a stock equals the sum of all of the company’s future dividends discounted back to their present value.

Breaking Down the Dividend Discount Model

The dividend discount model was developed under the assumption that the intrinsic value of a stock reflects the present value of all future cash flows generated by a security. At the same time, dividends are essentially the positive cash flows generated by a company and distributed to the shareholders.

Generally, the dividend discount model provides an easy way to calculate a fair stock price from a mathematical perspective with minimum input variables required. However, the model relies on several assumptions that cannot be easily forecasted.

Depending on the variation of the dividend discount model, an analyst requires forecasting future dividend payments, the growth of dividend payments, and the cost of equity capital. Forecasting all the variables precisely is almost impossible. Thus, in many cases, the theoretical fair stock price is far from reality.

Formula for the Dividend Discount Model

The dividend discount model can take several variations depending on the stated assumptions. The variations include the following:

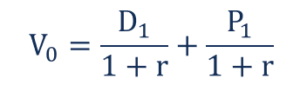

1. Gordon Growth Model

The Gordon Growth Model (GGM) is one of the most commonly used variations of the dividend discount model. The model is called after American economist Myron J. Gordon, who proposed the variation. The GGM assists an investor in evaluating a stock’s intrinsic value based on the potential dividend’s constant rate of growth.

The GGM is based on the assumption that the stream of future dividends will grow at some constant rate in the future for an infinite time. The model is helpful in assessing the value of stable businesses with strong cash flow and steady levels of dividend growth. It generally assumes that the company being evaluated possesses a constant and stable business model and that the growth of the company occurs at a constant rate over time.

Mathematically, the model is expressed in the following way:

Where:

- V0 – The current fair value of a stock

- D1 – The dividend payment in one period from now

- r – The estimated cost of equity capital (usually calculated using CAPM)

- g – The constant growth rate of the company’s dividends for an infinite time

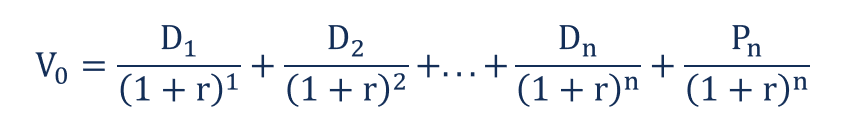

2. One-Period Dividend Discount Model

The one-period discount dividend model is used much less frequently than the Gordon Growth model. The former is applied when an investor wants to determine the intrinsic price of a stock that he or she will sell in one period (usually one year) from now.

The one-period DDM generally assumes that an investor is prepared to hold the stock for only one year. Because of the short holding period, the cash flows expected to be generated by the stock are the single dividend payment and the selling price of the respective stock.

Hence, to determine the fair price of the stock, the sum of the future dividend payment and that of the estimated selling price, must be computed and discounted back to their present values.

The one-period dividend discount model uses the following equation:

Where:

- V0 – The current fair value of a stock

- D1 – The dividend payment in one period from now

- P1 – The stock price in one period from now

- r – The estimated cost of equity capital

3. Multi-Period Dividend Discount Model

The multi-period dividend discount model is an extension of the one-period dividend discount model wherein an investor expects to hold a stock for multiple periods. The main challenge of the multi-period model variation is that forecasting dividend payments for different periods is required.

In the multiple-period DDM, an investor expects to hold the stock he or she purchased for multiple time periods. Therefore, the expected future cash flows will consist of numerous dividend payments, and the estimated selling price of the stock at the end of the holding period.

The intrinsic value of a stock (via the Multiple-Period DDM) is found by estimating the sum value of the expected dividend payments and the selling price, discounted to find their present values.

The model’s mathematical formula is below:

Notable Shortcomings of the DDM

A shortcoming of the DDM is that the model follows a perpetual constant dividend growth rate assumption. This assumption is not ideal for companies with fluctuating dividend growth rates or irregular dividend payments, as it increases the chances of imprecision.

Another drawback is the sensitivity of the outputs to the inputs. Furthermore, the model is not fit for companies with rates of return that are lower than the dividend growth rate.

Related Readings

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional resources below will be useful: